irrevocable trust capital gains tax rate 2020

The maximum tax rate for long-term. 2022 Long-Term Capital Gains Trust Tax Rates.

Minimizing Tax On The Sale Of Your Business Preliminary Sale To A Non Grantor Trust Keystone Business Transitions

Income and short-term capital gain generated by an irrevocable trust gets.

. The maximum tax rate for long-term. Browse Legal Forms by Category Fill Out E-Sign Share It Online. The highest trust and estate tax rate is 37.

Irrevocable trusts are very different from revocable trusts in the way they are. The maximum tax rate for long-term capital gains and qualified dividends is 20. What is the capital gains tax rate for trusts in 2020.

What is the capital gains tax rate for trusts in 2020. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Trusts pay the highest capital gains tax rate when taxable income exceeds.

The maximum tax rate for long-term. 20 The maximum tax rate for long. Capital gains tax on sale of.

Ad See How Our Private Bank Team Can Help Educate You and Your Family About Trusts. Capital gains however are not considered to be income to irrevocable trusts. What is the capital gains tax rate for trusts in 2020.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between. What is the capital gains tax rate for trusts in 2020. Know the basics when it comes to capital gains tax.

Ad Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. What is the capital gains tax rate for trusts in 2020. Ad Find Deals on turbo tax online in Software on Amazon.

July 7 2022 800 AM 4 min read. Track Clients Potential Tax Liability with Tax Evaluator. The maximum tax rate.

Capital gains however are not considered to be income to irrevocable trusts. An individual would have to make over 518500 in taxable income to be taxed at 37. The remaining amount is taxed at the current rate of Capital Gains Tax for.

What is the capital gains tax rate for trusts in 2020. Qualified dividends are taxed as capital gain rather than as ordinary income. The remaining amount is taxed at.

Examples of assets subject to capital gains taxes include homes stocks.

Incomplete And Completed Gift Non Grantor Trusts

2020 Year End Tax Planning For Trusts Can Yield Major Savings Accounting Today

10 Rules Of Thumb For Trust Income Taxation Gwa Blog

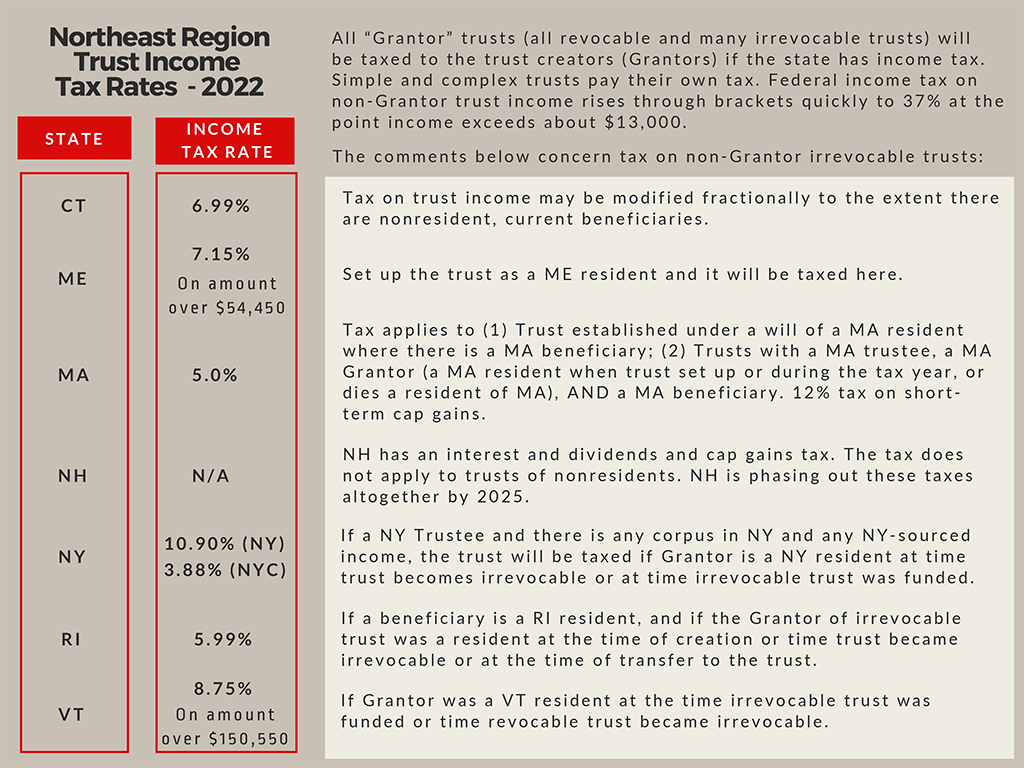

Trust Income Taxes Guide For The Northeast Borchers Trust Law

Do Irrevocable Trusts Pay The Capital Gains Tax

Irrevocable Trust Taxes My Caring Plan

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

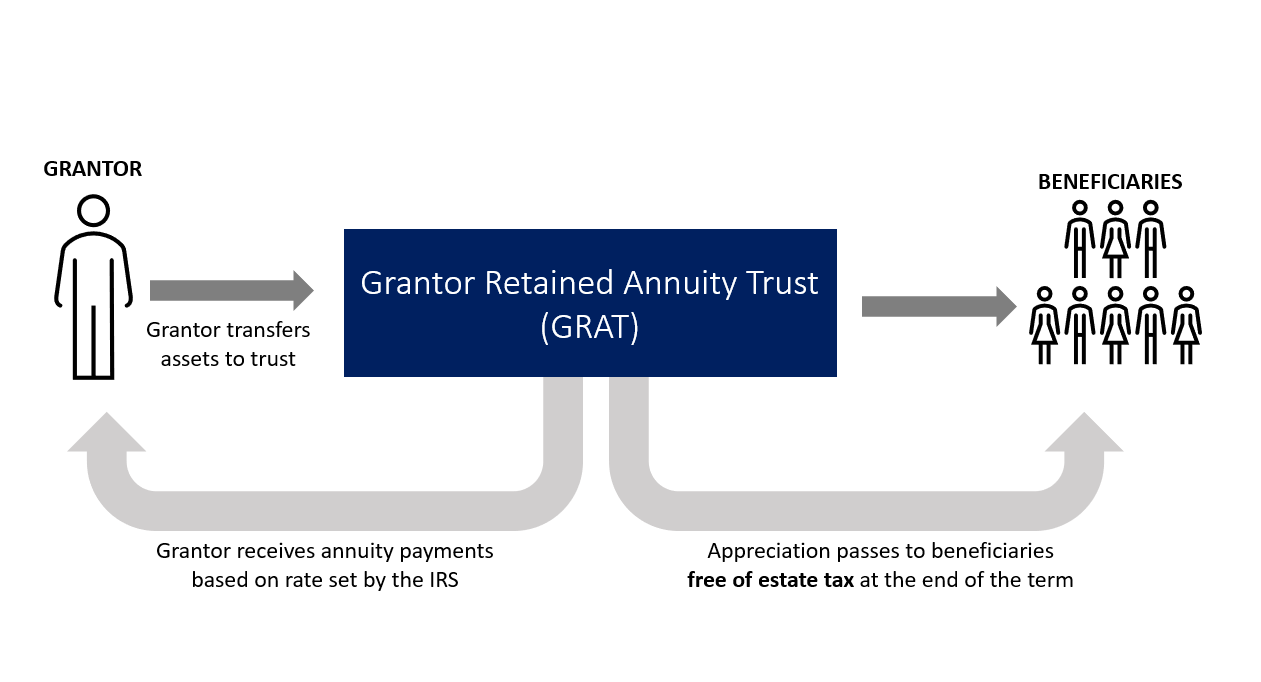

How To Use Grantor Retained Annuity Trusts Grats To Transfer Wealth To Beneficiaries Tax Free Plancorp

Navigating Family Trusts And Taxes Turbotax Tax Tips Videos

Income Taxation Of Trusts And Estates After Tax Reform

Installment Sale To An Idgt To Reduce Estate Taxes

Election Special Bulletin 1 Tax Plan Proposal

How Are Trusts Taxed Faqs Wealthspire

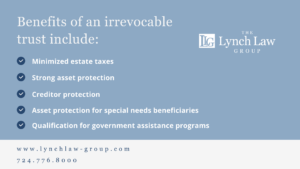

Should An Irrevocable Trust Be Part Of My Estate Plan The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

How Are Capital Gains Taxed Tax Policy Center

:max_bytes(150000):strip_icc()/TermDefinitions_Irrevocabletrust_finalv2-6213ef68ee82405cb533f2f26278d7a1.png)

Irrevocable Trusts Explained How They Work Types And Uses

Estate Planning San Francisco Bay Area Trust Probate And Conservatorship Litigation Lawyer Blog Talbot Law Group P C